AP Employees’ New DA Table 37.31% is given here.

D.A Enhancement from 0.3367 To 0.3731 | Difference: 0.0364 w.e.f JAN/2024

- PF holders Cash From OCT 2025

- CPS holders 10% to CPS and 90% Cash from JAN/2024 To OCT/2025

| PF Holders | CPS Holders | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Basic Pay | New D.A | Old D.A | Diffrnc | Credit to 21 (months) | Cash FROM | For CPS Holders 22(Months) | Basic Pay | New D.A | Old D.A | Diffrnc | Credit to 21 (months) | Cash FROM | For CPS Holders 22(Months) |

| 0.3731 | 0.3367 | 0.0364 | PF | OCT 2025 | CPS [10%] CASH [90%] | 0.3731 | 0.3367 | 0.0364 | PF | OCT 2025 | CPS [10%] CASH [90%] | ||

| 20000 | 7462 | 6734 | 728 | 15288 | 728 | 1533 14483 | 61960 | 23117 | 20862 | 2255 | 47355 | 2255 | 4746 44885 |

| 20600 | 7686 | 6936 | 750 | 15750 | 750 | 1575 14925 | 63660 | 23752 | 21434 | 2318 | 48678 | 2318 | 4872 46124 |

| 21800 | 8134 | 7340 | 794 | 16674 | 794 | 1659 15809 | 65360 | 24386 | 22007 | 2379 | 49959 | 2379 | 4998 47340 |

| 22460 | 8380 | 7562 | 818 | 17178 | 818 | 1722 16274 | 67190 | 25069 | 22623 | 2446 | 51366 | 2446 | 5145 48667 |

| 23120 | 8626 | 7785 | 841 | 17661 | 841 | 1764 16738 | 69020 | 25751 | 23239 | 2512 | 52752 | 2512 | 5271 49993 |

| 23780 | 8872 | 8007 | 865 | 18165 | 865 | 1827 17224 | 70850 | 26434 | 23855 | 2579 | 54159 | 2579 | 5418 51320 |

| 24500 | 9141 | 8249 | 892 | 18732 | 892 | 1869 17755 | 72810 | 27165 | 24515 | 2650 | 55650 | 2650 | 5565 52735 |

| 25220 | 9410 | 8492 | 918 | 19278 | 918 | 1932 18264 | 74770 | 27897 | 25175 | 2722 | 57162 | 2722 | 5712 54172 |

| 25940 | 9678 | 8734 | 944 | 19824 | 944 | 1974 18794 | 76730 | 28628 | 25835 | 2793 | 58653 | 2793 | 5859 55587 |

| 26720 | 9969 | 8997 | 972 | 20412 | 972 | 2037 19347 | 78820 | 29408 | 26539 | 2869 | 60249 | 2869 | 6027 57091 |

| 27500 | 10260 | 9259 | 1001 | 21021 | 1001 | 2100 19922 | 80910 | 30188 | 27242 | 2946 | 61866 | 2946 | 6195 58617 |

| 28280 | 10551 | 9522 | 1029 | 21609 | 1029 | 2163 20475 | 83000 | 30967 | 27946 | 3021 | 63441 | 3021 | 6342 60120 |

| 29130 | 10868 | 9808 | 1060 | 22260 | 1060 | 2226 21094 | 85240 | 31803 | 28700 | 3103 | 65163 | 3103 | 6510 61756 |

| 29980 | 11186 | 10094 | 1092 | 22932 | 1092 | 2289 21735 | 87480 | 32639 | 29455 | 3184 | 66864 | 3184 | 6678 63370 |

| 30830 | 11503 | 10380 | 1123 | 23583 | 1123 | 2352 22354 | 89720 | 33475 | 30209 | 3266 | 68586 | 3266 | 6867 64985 |

| 31750 | 11846 | 10690 | 1156 | 24276 | 1156 | 2436 22996 | 92110 | 34366 | 31013 | 3353 | 70413 | 3353 | 7035 66731 |

| 32670 | 12189 | 11000 | 1189 | 24969 | 1189 | 2499 23659 | 94500 | 35258 | 31818 | 3440 | 72240 | 3440 | 7224 68456 |

| 33590 | 12532 | 11310 | 1222 | 25662 | 1222 | 2562 24322 | 96890 | 36150 | 32623 | 3527 | 74067 | 3527 | 7413 70181 |

| 34580 | 12902 | 11643 | 1259 | 26439 | 1259 | 2646 25052 | 99430 | 37097 | 33478 | 3619 | 75999 | 3619 | 7602 72016 |

| 35570 | 13271 | 11976 | 1295 | 27195 | 1295 | 2730 25781 | 101970 | 38045 | 34333 | 3712 | 77952 | 3712 | 7791 73873 |

| 36560 | 13641 | 12310 | 1331 | 27951 | 1331 | 2793 26489 | 104510 | 38993 | 35189 | 3804 | 79884 | 3804 | 7980 75708 |

| 37640 | 14043 | 12673 | 1370 | 28770 | 1370 | 2877 27263 | 107210 | 40000 | 36098 | 3902 | 81942 | 3902 | 8190 77654 |

| 38720 | 14446 | 13037 | 1409 | 29589 | 1409 | 2961 28037 | 109910 | 41007 | 37007 | 4000 | 84000 | 4000 | 8400 79600 |

| 39800 | 14849 | 13401 | 1448 | 30408 | 1448 | 3045 28811 | 112610 | 42015 | 37916 | 4099 | 86079 | 4099 | 8610 81568 |

| 40970 | 15286 | 13795 | 1491 | 31311 | 1491 | 3129 29673 | 115500 | 43093 | 38889 | 4204 | 88284 | 4204 | 8820 83668 |

| 42140 | 15722 | 14189 | 1533 | 32193 | 1533 | 3213 30513 | 118390 | 44171 | 39862 | 4309 | 90489 | 4309 | 9051 85747 |

| 43310 | 16159 | 14582 | 1577 | 33117 | 1577 | 3318 31376 | 121280 | 45250 | 40835 | 4415 | 92715 | 4415 | 9282 87869 |

| 44570 | 16629 | 15007 | 1622 | 34062 | 1622 | 3402 32282 | 124380 | 46406 | 41879 | 4527 | 95067 | 4527 | 9513 90081 |

| 45830 | 17099 | 15431 | 1668 | 35028 | 1668 | 3507 33189 | 127480 | 47563 | 42923 | 4640 | 97440 | 4640 | 9744 92336 |

| 47090 | 17569 | 15855 | 1714 | 35994 | 1714 | 3591 34117 | 130580 | 48719 | 43966 | 4753 | 99813 | 4753 | 9975 94591 |

| 48440 | 18073 | 16310 | 1763 | 37023 | 1763 | 3696 35090 | 133900 | 49958 | 45084 | 4874 | 102354 | 4874 | 10227 97001 |

| 49790 | 18577 | 16764 | 1813 | 38073 | 1813 | 3801 36085 | 137220 | 51197 | 46202 | 4995 | 104895 | 4995 | 10500 99411 |

| 51140 | 19080 | 17219 | 1861 | 39081 | 1861 | 3906 37036 | 140540 | 52435 | 47320 | 5115 | 107415 | 5115 | 10752 101799 |

| 52600 | 19625 | 17710 | 1915 | 40215 | 1915 | 4032 38119 | 144150 | 53782 | 48535 | 5247 | 110187 | 5247 | 11025 104409 |

| 54060 | 20170 | 18202 | 1968 | 41328 | 1968 | 4137 39159 | 147760 | 55129 | 49751 | 5378 | 112938 | 5378 | 11298 107018 |

| 55520 | 20715 | 18694 | 2021 | 42441 | 2021 | 4242 40220 | 151370 | 56476 | 50966 | 5510 | 115710 | 5510 | 11571 109649 |

| 57100 | 21304 | 19226 | 2078 | 43638 | 2078 | 4368 41348 | 154980 | 57823 | 52182 | 5641 | 118461 | 5641 | 11844 112258 |

| 58680 | 21894 | 19758 | 2136 | 44856 | 2136 | 4494 42498 | 158880 | 59278 | 53495 | 5783 | 121443 | 5783 | 12138 115088 |

| 60260 | 22483 | 20290 | 2193 | 46053 | 2193 | 4599 43647 | 162780 | 60733 | 54808 | 5925 | 124425 | 5925 | 12453 117918 |

AP Employees New DA Table 26.39% is given here.

| NEW D.A. 3.64% ( FROM 22.75% TO 26.39%) | |||||||

| BASIC PAY | NEWD.A. @26.39% FROM 01.07.22 | PRESENT D.A. @22.75% FROM 01.01.22 | DIFFEREN CE 3.64% ONE MONTH | BASIC PAY | NEW D.A. @26.39% FROM 01.07.22 | PRESENT D.A. @22.75% FROM 01.01.22 | DIFFEREN CE 3.64% ONE MONTH |

| 20000 | 5278 | 4550 | 728 | 61960 | 16351 | 14096 | 2255 |

| 20600 | 5436 | 4687 | 749 | 63660 | 16800 | 14483 | 2317 |

| 21200 | 5595 | 4823 | 772 | 65360 | 17249 | 14869 | 2380 |

| 21800 | 5753 | 4960 | 793 | 67190 | 17731 | 15286 | 2445 |

| 22460 | 5927 | 5110 | 817 | 69020 | 18214 | 15702 | 2512 |

| 23120 | 6101 | 5260 | 841 | 70850 | 18697 | 16118 | 2579 |

| 23780 | 6276 | 5410 | 866 | 72810 | 19215 | 16564 | 2651 |

| 24500 | 6466 | 5574 | 892 | 74770 | 19732 | 17010 | 2722 |

| 25220 | 6656 | 5738 | 918 | 76730 | 20249 | 17456 | 2793 |

| 25940 | 6846 | 5901 | 945 | 78820 | 20801 | 17932 | 2869 |

| 26720 | 7051 | 6079 | 972 | 80910 | 21352 | 18407 | 2945 |

| 27500 | 7257 | 6256 | 1001 | 83000 | 21904 | 18883 | 3021 |

| 28280 | 7463 | 6434 | 1029 | 85240 | 22495 | 19392 | 3103 |

| 29130 | 7687 | 6627 | 1060 | 87480 | 23086 | 19902 | 3184 |

| 29980 | 7912 | 6820 | 1092 | 89720 | 23677 | 20411 | 3266 |

| 30830 | 8136 | 7014 | 1122 | 92110 | 24308 | 20955 | 3353 |

| 31750 | 8379 | 7223 | 1156 | 94500 | 24939 | 21499 | 3440 |

| 32670 | 8622 | 7432 | 1190 | 96890 | 25569 | 22042 | 3527 |

| 33590 | 8864 | 7642 | 1222 | 99430 | 26240 | 22620 | 3620 |

| 34580 | 9126 | 7867 | 1259 | 101970 | 26910 | 23198 | 3712 |

| 35570 | 9387 | 8092 | 1295 | 104510 | 27580 | 23776 | 3804 |

| 36560 | 9648 | 8317 | 1331 | 107210 | 28293 | 24390 | 3903 |

| 37640 | 9933 | 8563 | 1370 | 109910 | 29005 | 25005 | 4000 |

| 38720 | 10218 | 8809 | 1409 | 112610 | 29718 | 25619 | 4099 |

| 39800 | 10503 | 9055 | 1448 | 115500 | 30480 | 26276 | 4204 |

| 40970 | 10812 | 9321 | 1491 | 118390 | 31243 | 26934 | 4309 |

| 42140 | 11121 | 9587 | 1534 | 121280 | 32006 | 27591 | 4415 |

| 43310 | 11430 | 9853 | 1577 | 124380 | 32824 | 28296 | 4528 |

| 44570 | 11762 | 10140 | 1622 | 127480 | 33642 | 29002 | 4640 |

| 45830 | 12095 | 10426 | 1669 | 130580 | 34460 | 29707 | 4753 |

| 47090 | 12427 | 10713 | 1714 | 133900 | 35336 | 30462 | 4874 |

| 48440 | 12783 | 11020 | 1763 | 137220 | 36212 | 31218 | 4994 |

| 49790 | 13140 | 11327 | 1813 | 140540 | 37089 | 31973 | 5116 |

| 51140 | 13496 | 11634 | 1862 | 144150 | 38041 | 32794 | 5247 |

| 52600 | 13881 | 11967 | 1914 | 147760 | 38994 | 33615 | 5379 |

| 54060 | 14266 | 12299 | 1967 | 151370 | 39947 | 34437 | 5510 |

| 55520 | 14652 | 12631 | 2021 | 154980 | 40899 | 35258 | 5641 |

| 57100 | 15069 | 12990 | 2079 | 158880 | 41928 | 36145 | 5783 |

| 58680 | 15486 | 13350 | 2136 | 162780 | 42958 | 37032 | 5926 |

| 60260 | 15903 | 13709 | 2194 | 166680 | 43987 | 37920 | 6067 |

PAY PARTICULARS TABLE WITH NEW DA 26.39%

BASIC PAY | DA@ 26.39% | HRA@ l.0% | TOTAL | BASIC PAY | DA@ 26.39% | HRA@ 10% | TOTAL |

20000 | 5278 | 2000 | 27278 | 61960 | 16351 | 6196 | 84507 |

20600 | 5436 | 2060 | 28096 | 63660 | 16800 | 6366 | 86826 |

21200 | 5595 | 2120 | 28915 | 65360 | 17249 | 6536 | 89145 |

21800 | 5753 | 2180 | 29733 | 67190 | 17731 | 6719 | 91640 |

22460 | 5927 | 2246 | 30633 | 69020 | 18214 | 6902 | 94136 |

23120 | 6101 | 2312 | 31533 | 70850 | 18697 | 7085 | 96632 |

23780 | 6276 | 2378 | 32434 | 72810 | 19215 | 7281 | 99306 |

24500 | 6466 | 2450 | 33416 | 74770 | 19732 | 7477 | 101979 |

25220 | 6656 | 2522 | 34398 | 76730 | 20249 | 7673 | 104652 |

25940 | 6846 | 2594 | 35380 | 78820 | 20801 | 7882 | 107503 |

26720 | 7051 | 2672 | 36443 | 80910 | 21352 | 8091 | 110353 |

27500 | 7257 | 2750 | 37507 | 83000 | 21904 | 8300 | 113204 |

28280 | 7463 | 2828 | 38571 | 85240 | 22495 | 8524 | 116259 |

29130 | 7687 | 2913 | 39730 | 87480 | 23086 | 8748 | 119314 |

29980 | 7912 | 2998 | 40890 | 89720 | 23677 | 8972 | 122369 |

30830 | 8136 | 3083 | 42049 | 92110 | 24308 | 9211 | 125629 |

31750 | 8379 | 3175 | 43304 | 94500 | 24939 | 9450 | 128889 |

32670 | 8622 | 3267 | 44559 | 96890 | 25569 | 9689 | 132148 |

33590 | 8864 | 3359 | 45813 | 99430 | 26240 | 9943 | 135613 |

34580 | 9126 | 3458 | 47164 | 101970 | 26910 | 10197 | 139077 |

35570 | 9387 | 3557 | 48514 | 104510 | 27580 | 10451 | 142541 |

36560 | 9648 | 3656 | 49864 | 107210 | 28293 | 10721 | 146224 |

37640 | 9933 | 3764 | 51337 | 109910 | 29005 | 10991 | 149906 |

38720 | 10218 | 3872 | 52810 | 112610 | 29718 | 11000 | 153328 |

39800 | 10503 | 3980 | 54283 | 115500 | 30480 | 11000 | 156980 |

40970 | 10812 | 4097 | 55879 | 118390 | 31243 | 11000 | 160633 |

42140 | 11121 | 4214 | 57475 | 121280 | 32006 | 11000 | 164286 |

43310 | 11430 | 4331 | 59071 | 124380 | 32824 | 11000 | 168204 |

44570 | 11762 | 4457 | 60789 | 127480 | 33642 | 11000 | 172122 |

45830 | 12095 | 4583 | 62508 | 130580 | 34460 | 11000 | 176040 |

47090 | 12427 | 4709 | 64226 | 133900 | 35336 | 11000 | 180236 |

48440 | 12783 | 4844 | 66067 | 137220 | 36212 | 11000 | 184432 |

49790 | 13140 | 4979 | 67909 | 140540 | 37089 | 11000 | 188629 |

51140 | 13496 | 5114 | 69750 | 144150 | 38041 | 11000 | 193191 |

52600 | 13881 | 5260 | 71741 | 147760 | 38994 | 11000 | 197754 |

54060 | 14266 | 5406 | 73732 | 151370 | 39947 | 11000 | 202317 |

55520 | 14652 | 5552 | 75724 | 154980 | 40899 | 11000 | 206879 |

57100 | 15069 | 5710 | 77879 | 158880 | 41928 | 11000 | 211808 |

58680 | 15486 | 5868 | 80034 | 162780 | 42958 | 11000 | 216738 |

60260 | 15903 | 6026 | 82189 | 166680 | 43987 | 11000 | 221667 |

wef 01.07.2019 GO.99 Released

Here is the Total DA to AP Employees after PRC: Its 20.93%

కేంద్ర ప్రభుత్వం 7వ వేతన సవరణ ప్రకారం ఇచ్చే 1% డి.ఏకు రాష్ట్ర ప్రభుత్వం 0.910% చెల్లించనున్నారు.

01.07.2018 నుండి 0%

01.01.2019 నుండి కేంద్ర ప్రభుత్వం ఇచ్చిన 3% కు గాను మనకు 3×0.91=2.73 కుమ్యులేటివ్ గా 0%+0.273%= 2.73% వస్తుంది.

01.07.2019 నుండి కేంద్ర ప్రభుత్వం 5% కు గాను మనకు 5×0.91=4.55 కుమ్యులేటివ్ గా 0.273% + 4.55%= 7.28% వస్తుంది.

1.1.20 నాటి కేంద్ర ప్రభుత్వ DA 4% దీనికి సమానమైన రాష్ట్ర ప్రభుత్వం DA 3.64%.ఇప్పుడు మొత్తం DA 10.92%.

1.7.20 నాటి కేంద్ర ప్రభుత్వం DA 3%.దీనికి సమానమైన రాష్ట్ర ప్రభుత్వం DA 2.73%.ఇప్పుడు మొత్తం DA 13.65%.

1.1.21 న కేంద్ర ప్రభుత్వం DA 4%.దానికి అనుగుణంగా రాష్ట్ర ప్రభుత్వం DA 3.64%.ఇప్పుడు మొత్తం DA 17.29%.

1.7.21 నాటి కేంద్ర ప్రభుత్వం DA 4%.దానికి అనుగుణంగా రాష్ట్ర ప్రభుత్వం DA 3.64%.ఇప్పుడు మొత్తం DA 20.93%.

——————————————————–

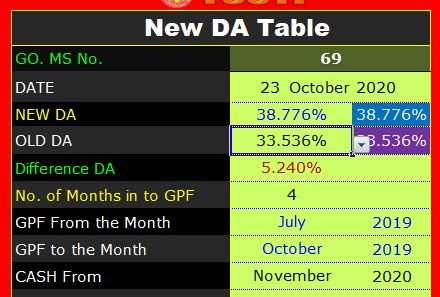

DA @ 38.776% FROM 01.07.2019…DA G.O.MS.NO. 99 Dt. 20-12-2021 released: Main Features in the GO are –

Cash paid in 01/2022 Arrears from 01.07.2019 to 31.12.2021 adjust to PF AC’s in 5 installments

Instalment (1) 01.07.2019 to 31.12.2019=6 months in Feb 2022

Instalment (2) 01.01.2020 to 30.06.2020=6 months in March 2022

Instalment (3) 01.07.2020 to 31.12.2020 =6 months in April 2022

Instalment (4) 01.01.2021 to 30.06.2021=6 months in May 2022

Instalment (5) 01.07.2021 to 31.12.2021= 6 months in June 2022

ORDER:

In the reference 13th read above, Government have revised the rates of Dearness Allowance (DA) sanctioned in the reference 12th read above to the employees of Government of Andhra Pradesh from 27.248% of the basic pay to 30.392% of basic pay w.e.f. the 1st of July, 2018. Further, Government have decided to release the balance DA instalments in a time bound manner. Accordingly, Government have issued orders that the 2nd DA (which is due from 1st January 2019) will be released from the July 2021 salary onwards. The detailed instructions for the release of the 2nd DA (which is due from 1st January 2019) will be issued in the month of June 2021. Government have issued amendment to para 8 of orders in the reference 13th read above, that the employees who are retired/ due to retire from service between 01.07.2018 & 30.06.2021 the arrears of Dearness Allowance shall be drawn and paid in cash vide reference 14th read above. Government have issued orders in the reference 15th read above for the revision of Dearness Allowance (DA) sanctioned in the Government Orders in the reference 13th read above to the employees of Government of Andhra Pradesh from 30.392% of the basic pay to 33.536% of basic pay w.e.f. the 1st of January, 2019.

2.In accordance with the orders issued in para 23 and 24 of the reference 13th read above, Government hereby order the revision of the Dearness Allowance (DA) sanctioned in the Government Orders in the reference 13th read above to the employees of Government of Andhra Pradesh from 33.536% of the basic pay to 38.776% of basic pay w.e.f. the 1st of July, 2019.

3. The Dearness Allowance sanctioned in the above para is also applicable to the following ~mployees.

1. The employees of Zilla Parishads, Mandal Parishads, Gram Panchayats, Municipalities, Municipal Corporations, Agricultural Market Committees and Zilla Grandhalaya Samsthas, work charged Establishment, who are drawing pay in a regular scale of pay in the Revised Pay Scales, 2015.

ii. Teaching & Non-Teaching staff of Aided Institutions including Aided Polytechnics who are drawing pay in a regular scale of pay in the Revised Pay Scales, 2015.

iii. Non-Teaching staff of Universities including A.P. Agricultural University,

Jawaharlal Nehru Technological University & Dr. YSR Horticulture University who are drawing pay in a regular scale of pay in the Revised Pay Scales, 2015.

4. Government also hereby order the revision of Dearness Allowance rates in respect of State Government employees drawing the Revised U.G.C Pay Scales,

2006, from the existing 154 % to 164% of the basic pay w.e.f. 1st of July, 2019. These rates of Dearness Allowance are also applicable to:

i. Teaching staff of Government & Aided Affiliated Degree Colleges who are drawing pay in the Revised U.G.c. Pay Scales, 2006.

ii. Teaching staff of the Universities including the A.P. Agricultural University, Jawaharlal Nehru Technological University and Dr. YSR Horticulture University and the Teaching staff of Govt. Polytechnics who are drawing pay in the Revised UGC/ AICfE Pay Scales, 2006.

5. Government also hereby order the revision of Dearness Allowance rates in respect of State Government employees drawing the Revised U.G.c. Pay Scales,

2016 from the existing 12 % to 17 % of the basic pay with effect from 1st July, 2019 (after implementation of Revised u.G.c. Pay Scales, 2016). These rates of Dearness Allowance are also applicable to:

I. Teaching staff of Government & Aided Affiliated Degree Colleges who are drawing pay in the Revised u.G.C Pay Scales, 2016.

ii. Teaching staff of the Universities including the A.P. Agricultural University, the Jawaharlal Nehru Technological University & the Dr. YSR Horticulture University and the Teaching staff of Govt. Polytechnics who are drawing pay in the Revised UGC/ AICI’E Pay Scales, 2016.

6. Government also hereby order the revision of rates of Dearness Allowance in respect of Judicial Officers whose pay scales were revised as per the Shri E. Padmanabhan Committee Report, vide the G.O.Ms.No.73,Law(LA&J SC-F) Department dt: 01.05.2010 from 154% to 164% with effect from 1st July, 2019.

7. Government hereby order the revision of Dearness Allowance rate sanctioned in the G.O. in the reference 13th read above to the State Government employees who are drawing in the Andhra Pradesh Revised Pay Scales, 2010 from 118.128% to 123.368% of the basic pay with effect from 1st July, 2019. These rates of Dearness Allowance are also applicable to:

i. The employees of Zilla Parishads, Mandal Parishads, Gram Panchayats, Committees and Zilla Grandhalaya Samsthas & Work Charged Establishment who are drawing pay in a regular scale of pay in the Revised Pay Scales, 2010.

ii. Teaching and Non-Teaching Staff of Aided Institutions including Aided Polytechnics who are drawing pay in a regular scale of pay in the Revised Pay Scales, 2010.

iii. Teaching & Non-Teaching Staff of Universities including A.P.

Agricultural University, the Jawaharlal Nehru Technological University and Dr. YSR Horticulture University who are drawing pay in a regular scale of pay in the Revised Pay Scales, 2010.

8. The Dearness Allowance sanctioned in the paras 2-7 above shall be paid in cash with salary of January, 2022 onwards. The arrears on account of payment of Dearness Allowance for the period from 1st July, 2019 to 31st December, 2021 shall be credited to the General Provident Fund Account of the respective employees in three equal instalments from January, 2022 Salaries onwards.

9. The employees who are retired/ due to retire from service between 01.07.2019& 30.06.2022 the arrears of Dearness Allowance shall be drawn and paid in cash as the employee due for retirement on superannuation is exempted from making any subscription to the General Provident Fund during the last four months of service.

10. In respect of employees who were appointed to Government service on or after 01.09.2004 and governed by the Contributory Pension Scheme (CPS), the arrears of Dearness Allowance payable for the period from 1st July, 2019 to 31st December, 2022 shall be paid in cash in three equal instalments from January, 2022 salaries onwards. 10% of the arrears shall be credited to the PRAN accounts of the individuals along with Government share as per G.O.Ms.No.250, Finance (pen. I) Department, dated: 06-09-2012 and the remaining 90% shall be credited to the employees’ salary Accounts.

11. In the event of death of any employee before the issue of these orders, the legal heir(s) shall be entitled to the arrears of Dearness allowance in cash.

12. The term ‘Pay’ for this purpose shall be as defined in F.R.9 (21) (a) (i).

13. The Drawing Officer shall prefer the bill on the Pay & Accounts Officer, Ibrahimpatnam, Vijayawada or the Pay & Accounts Officer/ the Assistant Pay & Accounts Officer of the Andhra Pradesh Works Accounts Service or the Treasury Officer, as the case may be, for the amount of arrears for the period from 1st July, 2019 to 31st December, 2021 to be adjusted to the General Provident Fund Account in three equal instalments in respect of employees who are having a General Provident Fund Account in the month of December, 2021.

14. The Drawing Officers shall ensure that the Bills are supported by proper schedules in duplicate indicating details of the employee, the General Provident Fund Account Number /PRAN Account Number and the amount to be credited to the General Provident Fund Account/PRAN, to the Pay & Accounts Officer/Treasury Officers/ Assistant Pay & Accounts Officers or Pay & Accounts Officers of the Andhra Pradesh Works Accounts Service, as the case may be. The Pay & Accounts Officer/ Assistant Pay & Accounts Officer or Pay and Accounts Officer of the Andhra Pradesh Works Accounts Service/District Treasury Officer/Sub-Treasury Officer shall follow the usual procedure of furnishing one copy of the schedules along with bills to the Accountant General based on which the Accountant General shall credit the amounts to the General Provident Fund Accounts of the individuals concerned. The second copy of the schedules shall be furnished to the Drawing Officers with Voucher Numbers.

15. All Drawing Officers are requested to ensure that the bills as per the above orders are drawn and the amounts credited to General Provident Fund Account in three equal instalments in the months of January, February, and March, 2022.

16. In respect of the employees working in the Government Offices under his audit control, the Pay & Accounts Officer shall consolidate and furnish the information in the proforma annexed (Annexure-I) to this order to the Finance (PC and TA) Department by 30th April, 2022.

17. All the Audit Officers (Sub-Treasury Officers) are requested to furnish the figures of the amount credited to the General Provident Fund Account and the amounts credited to PRAN Accounts in the prescribed proforma (Annexure-I) enclosed, to the District Treasury by 30th April, 2022.

18. The Deputy Directors of District Treasuries in tum shall consolidate the information & furnish the same in the same proforma to the Director of Treasuries & Accounts by 31st May, 2022 & who in tum shall furnish the information to the Government by 30thJune, 2022.

19. In respect of employees of the Local Bodies, the Drawing Officers shall furnish the above information in the prescribed proforma as per Annexure-I to the Audit Officer of the District concerned before 30th April, 2022 & who will in tum furnish the consolidated information to the Director of State Audit by 31st May, 2022. The Director of State Audit in tum shall furnish the consolidated information to the Secretary to Government, Finance (PC and TA) Department by 30th June, 2022.

20. In regard to the Project Staff, the Joint Director of Works & Accounts of each Project shall furnish the information in the prescribed proforma as per Annexure- I to Director of Works Accounts by 31st May, 2022 & who in tum shall furnish the information to the Finance (PC & TA) Department by 30th June, 2022.

21. The expenditure on the Dearness Allowance to the employees of Agricultural Market Committees shall be met from their own funds.

22. All the Drawing & Disbursing Officers and the Audit Officers are requested to intimate to the employees working under their control as to how much amount of arrears of Dearness Allowance is credited to the General Provident Fund Account/ PRAN Account as per the Proforma annexed (Annexure-II) to this order. They are further requested to adhere to the above instructions and any deviation or noncompliance of these instructions will be viewed seriously.

23. All Heads of the Departments and Departments of Secretariat are requested to issue suitable instructions to the Drawing and Disbursing Officers under their control and to see that these instructions are followed scrupulously. The Director of Treasuries and Accounts/Director of State Audit/Pay & Accounts Officer/Director of Works and Accounts, Andhra Pradesh, Ibrahimpatnam, Vijayawada are requested to issue suitable instructions to their subordinate Audit Officers so that these instructions are carefully followed by them.

DA @ 33.536% FROM 01.01.2019 Cash paid in 07/2021 Arrears from 01.01.2019 to 30.06.2021 adjust to PF AC’s in 3 installments

DA Arrears of 30 months pending since January 2019 will be paid in three installments from July month. First installment will be paid with Salary of July 2021. Below table gives you Complete Details of Salary perticulars

New DA Table (@ 30.392% (27.248%+3.144%) of AP Govt Employees):

The Mentioned rate of DA table will be applicable to The employees of Zilla Parishads, Mandal Parishads, Gram Panchayats,Municipalities, Municipal Corporations, Agricultural Market Committees and Zilla Grandhalaya Samasthas, Work Charged Establishment, who are drawing pay in a regular scale of pay in the Revised Pay Scales, 2015. Teaching and Non-Teaching Staff of Aided Institutions including Aided Polytechnics who are drawing pay in a regular scale of pay in the Revised Pay Scales, 2015. Teaching and Non-Teaching Staff of Universities including Acharya N.G. Ranga Agricultural University, Jawaharlal Nehru Technological University who are drawing pay in a regular scale of pay in the Revised Pay Scales, 2015.

AP Govt DA Hike to 30.392% from July 2018 (GO No. 94) Dated 4.11.2020

AP Govt DA Hike to 30.392% from July 2018 (GO No. 94) Dated 4.11.2020

AP New DA Table 2020: DA Ready Reckoner New DA 30.392% Differance DA @ 3.14

| Basic Pay | New DA 30.392% | Old DA 27.248% | Difference 3.144% | Basic pay | New DA 30.392% | Old DA 27.248% | Difference 3.144% |

| 13000 | 3951 | 3542 | 409 | 37100 | 11275 | 10109 | 1166 |

| 13390 | 4069 | 3649 | 420 | 38130 | 11588 | 10390 | 1198 |

| 13780 | 4188 | 3755 | 433 | 39160 | 11902 | 10670 | 1232 |

| 14170 | 4307 | 3861 | 446 | 40270 | 12239 | 10973 | 1266 |

| 14600 | 4437 | 3978 | 459 | 41380 | 12576 | 11275 | 1301 |

| 15030 | 4568 | 4095 | 473 | 42490 | 12914 | 11578 | 1336 |

| 15460 | 4699 | 4213 | 486 | 43680 | 13275 | 11902 | 1373 |

| 15930 | 4841 | 4341 | 500 | 44870 | 13637 | 12226 | 1411 |

| 16400 | 4984 | 4469 | 515 | 46060 | 13999 | 12550 | 1449 |

| 16870 | 5127 | 4597 | 530 | 47330 | 14385 | 12896 | 1489 |

| 17380 | 5282 | 4736 | 546 | 48600 | 14771 | 13243 | 1528 |

| 17890 | 5437 | 4875 | 562 | 49870 | 15156 | 13589 | 1567 |

| 18400 | 5592 | 5014 | 578 | 51230 | 15570 | 13959 | 1611 |

| 18950 | 5759 | 5163 | 596 | 52590 | 15983 | 14330 | 1653 |

| 19500 | 5926 | 5313 | 613 | 53950 | 16396 | 14700 | 1696 |

| 20050 | 6094 | 5463 | 631 | 55410 | 16840 | 15098 | 1742 |

| 20640 | 6273 | 5624 | 649 | 56870 | 17284 | 15496 | 1788 |

| 21230 | 6452 | 5785 | 667 | 58330 | 17728 | 15894 | 1834 |

| 21820 | 6632 | 5946 | 686 | 59890 | 18202 | 16319 | 1883 |

| 22460 | 6826 | 6120 | 706 | 61450 | 18676 | 16744 | 1932 |

| 23100 | 7021 | 6294 | 727 | 63010 | 19150 | 17169 | 1981 |

| 23740 | 7215 | 6469 | 746 | 64670 | 19655 | 17621 | 2034 |

| 24440 | 7428 | 6659 | 769 | 66330 | 20159 | 18074 | 2085 |

| 25140 | 7641 | 6850 | 791 | 67990 | 20664 | 18526 | 2138 |

| 25840 | 7853 | 7041 | 812 | 69750 | 21198 | 19005 | 2193 |

| 26600 | 8084 | 7248 | 836 | 71510 | 21733 | 19485 | 2248 |

| 27360 | 8315 | 7455 | 860 | 73270 | 22268 | 19965 | 2303 |

| 28120 | 8546 | 7662 | 884 | 75150 | 22840 | 20477 | 2363 |

| 28940 | 8795 | 7886 | 909 | 77030 | 23411 | 20989 | 2422 |

| 29760 | 9045 | 8109 | 936 | 78910 | 23982 | 21501 | 2481 |

| 30580 | 9294 | 8332 | 962 | 80930 | 24596 | 22052 | 2544 |

| 31460 | 9561 | 8572 | 989 | 82950 | 25210 | 22602 | 2608 |

| 32340 | 9829 | 8812 | 1017 | 84970 | 25824 | 23153 | 2671 |

| 33220 | 10096 | 9052 | 1044 | 87130 | 26481 | 23741 | 2740 |

| 34170 | 10385 | 9311 | 1074 | 89290 | 27137 | 24330 | 2807 |

| 35120 | 10674 | 9569 | 1105 | 91450 | 27793 | 24918 | 2875 |

| 36070 | 10962 | 9828 | 1134 | 93780 | 28502 | 25553 | 2949 |

Download DA Reckoner

GROSS Ready Reckoner with New DA 30.392% + HRA 12%

| Basic Pay | New DA 30.392% | HRA 12% | IR 27% | TOTAL (B.P+ DA+HRA+IR) | Basic Pay | New DA 30 392%. | HRA 12% | IR 27% | TOTAL (B.P+ DA+HRA+IR) |

| 13000 | 3951 | 1560 | 3510 | 22021 | 37100 | 11275 | 4452 | 10017 | 62844 |

| 13390 | 4069 | 1607 | 3615 | 22681 | 38130 | 11588 | 4576 | 10295 | 64589 |

| 13780 | 4188 | 1654 | 3721 | 23343 | 39160 | 11902 | 4699 | 10573 | 66334 |

| 14170 | 4307 | 1700 | 3826 | 24003 | 40270 | 12239 | 4832 | 10873 | 68214 |

| 14600 | 4437 | 1752 | 3942 | 24731 | 41380 | 12576 | 4966 | 11173 | 70095 |

| 15030 | 4568 | 1804 | 4058 | 25460 | 42490 | 12914 | 5099 | 11472 | 71975 |

| 15460 | 4699 | 1855 | 4174 | 26188 | 43680 | 13275 | 5242 | 11794 | 73991 |

| 15930 | 4841 | 1912 | 4301 | 26984 | 44870 | 13637 | 5384 | 12115 | 76006 |

| 16400 | 4984 | 1968 | 4428 | 27780 | 46060 | 13999 | 5527 | 12436 | 78022 |

| 16870 | 5127 | 2024 | 4555 | 28576 | 47330 | 14385 | 5680 | 12779 | 80174 |

| 17380 | 5282 | 2086 | 4693 | 29441 | 48600 | 14771 | 5832 | 13122 | 82325 |

| 17890 | 5437 | 2147 | 4830 | 30304 | 49870 | 15156 | 5984 | 13465 | 84475 |

| 18400 | 5592 | 2208 | 4968 | 31168 | 51230 | 15570 | 6148 | 13832 | 86780 |

| 18950 | 5759 | 2274 | 5117 | 32100 | 52590 | 15983 | 6311 | 14199 | 89083 |

| 19500 | 5926 | 2340 | 5265 | 33031 | 53950 | 16396 | 6474 | 14567 | 91387 |

| 20050 | 6094 | 2406 | 5414 | 33964 | 55410 | 16840 | 6649 | 14961 | 93860 |

| 20640 | 6273 | 2477 | 5573 | 34963 | 56876 | 17284 | 6824 | 15355 | 96333 |

| 21230 | 6452 | 2548 | 5732 | 35962 | 55330 | 17728 | 7000 | 15749 | 98807 |

| 21820 | 6632 | 2618 | 5891 | 36961 | 59890 | 18202 | 7187 | 16170 | 101449 |

| 22460 | 6826 | 2695 | 6064 | 38045 | 61450 | 18676 | 7374 | 16592 | 104092 |

| 23100 | 7021 | 2772 | 6237 | 39130 | 63010 | 19150 | 7561 | 17013 | 106734 |

| 23740 | 7215 | 2849 | 6410 | 40214 | 64670 | 19655 | 7760 | 17461 | 109546 |

| 24440 | 7428 | 2933 | 6599 | 41400 | 66330 | 20159 | 7960 | 17909 | 112358 |

| 25140 | 7641 | 3017 | 6788 | 42586 | 67990 | 20664 | 8159 | 18357 | 115170 |

| 25840 | 7853 | 3101 | 6977 | 43771 | 69750 | 21198 | 8370 | 18833 | 118151 |

| 26600 | 8084 | 3192 | 7182 | 45058 | 71510 | 21733 | 8581 | 19308 | 121132 |

| 27360 | 8315 | 3283 | 7387 | 46345 | 73270 | 22268 | 8792 | 19783 | 124113 |

| 28120 | 8546 | 3374 | 7592 | 47632 | 75150 | 22840 | 9018 | 20291 | 127299 |

| 28940 | 8795 | 3473 | 7814 | 49022 | 77030 | 23411 | 9244 | 20798 | 130483 |

| 29760 | 9045 | 3571 | 8035 | 50411 | 78910 | 23982 | 9469 | 21306 | 133667 |

| 30580 | 9294 | 3670 | 8257 | 51801 | 80930 | 24596 | 9712 | 21851 | 137089 |

| 31460 | 9561 | 3775 | 8494 | 53290 | 82950 | 25210 | 9954 | 22397 | 140511 |

| 32340 | 9829 | 3881 | 8732 | 54782 | 84970 | 25824 | 10196 | 22942 | 143932 |

| 33220 | 10096 | 3986 | 8969 | 56271 | 87130 | 26481 | 10456 | 23525 | 147592 |

| 34170 | 10385 | 4100 | 9226 | 57881 | 89290 | 27137 | 10715 | 24108 | 151250 |

| 35120 | 10674 | 4214 | 9482 | 59490 | 91450 | 27793 | 10974 | 24692 | 154909 |

| 36070 | 10962 | 4328 | 9739 | 61099 | 93780 | 28502 | 11254 | 25321 | 158857 |

AP New DA Table, DA Enhanced from 22.008% to 24.104% Difference 2.096 (Crash from March 2018), 14 months i.e., from Jan 2017 to Feb 2018 Arrear credit to PF Account.

Click here for New DA Table

New DA Table Calculator ( Prepared by Ramanjaneyulu, Teachernews.in) : Click Here